How to Go to School for Free: Complete Resource for College and Graduate School Education

Picture yourself earning your diploma from university or graduate studies without the burden of substantial debt. The right strategies transform free education from a dream into reality.

The rapid increase in tuition expenses pushes many people to prioritize finding free educational opportunities. This guide provides high school students and undergraduates as well as prospective graduate students with established methods to fund their education at no cost. This section provides you with steps to follow and expert advice along with actual success stories for securing funding and navigating financial aid as a student.

Why Free Education Matters

Higher education presents opportunities yet costs remain intimidating. During 2024 public colleges within state boundaries had average tuition costs of $10,940 while private institutions demanded fees of $39,400 according to the College Board. Grad school can exceed $20,000 annually. Scholarships and grants alongside work programs remove tuition costs which allows students to concentrate on their studies. This article guides readers through the process of maximizing free educational opportunities for both college and graduate studies.

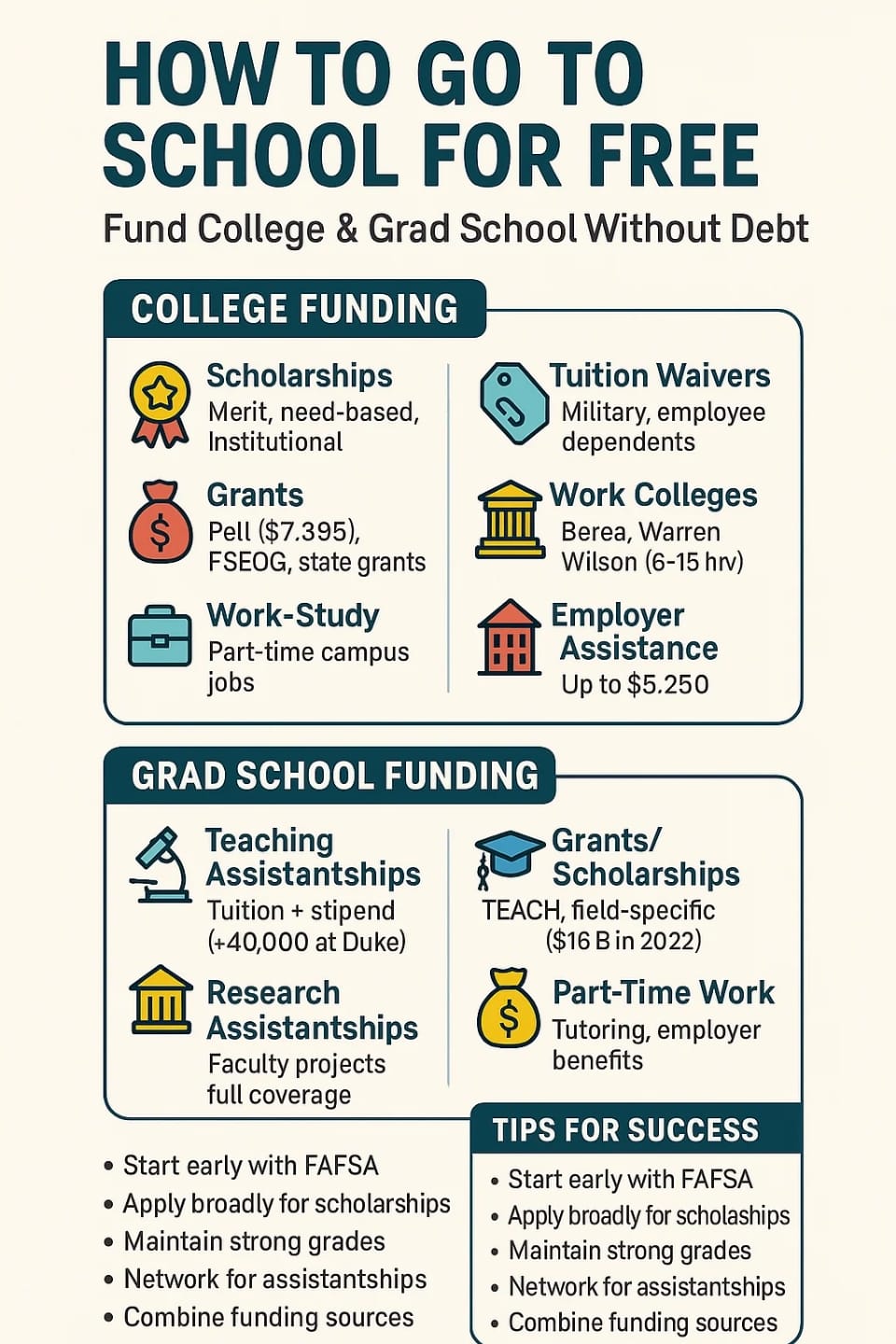

How to Go to College for Free

Scholarships: Your Ticket to Free Tuition

Scholarships represent financial awards given without repayment requirements and are granted based on academic achievement, financial need or special characteristics. Multiple types of scholarships including academic and athletic awards are listed on platforms such as Fastweb and Scholarships.com.

- Merit-Based: Reward high grades or talents. The National Merit Scholarship awards up to $2,500 to outstanding PSAT participants.

- Need-Based: Target low-income students via FAFSA. Check Bankrate’s guide for options.

- Institutional: Colleges offer in-house awards. Search for institutional scholarships through the College Board’s Scholarship Search tool.

Tip: Apply early—deadlines often hit in junior year. Platforms like Going Merry simplify the process.

Grants: Free Money for Need-Based Students

Grants, like scholarships, don’t require repayment. The Pell Grant supplies up to $7,395 for the 2024-25 academic year according to NerdWallet. Other options include:

- FSEOG: Up to $4,000 for high-need students.

- TEACH Grant: Serves students who plan to become teachers according to Federal Student Aid.

- State Grants: Like California’s Cal Grant.

Tip: The first students to submit their FAFSA applications receive priority access to grants. Research state programs via Scholarships360.

Work-Study Programs: Earn While You Learn

The Federal Work-Study Program provides part-time employment opportunities for students who demonstrate financial need according to ACT. According to ISAC, positions such as library or community work provide students with necessary funds while preserving their eligibility for future financial aid.

Tip: Check “work-study” on FAFSA. Balance 10-20 weekly hours with studies.

Tuition Waivers: Slash Costs with Eligibility

Specific groups can receive reduced or completely waived tuition fees according to AffordableCollegesOnline. Examples include:

- Military veterans or dependents.

- University employee families.

- Foster care alumni, per Florida DOE.

Tip: The eligibility for tuition waivers requires contacting financial aid offices as indicated by Bankrate.

Free Community College: A Growing Trend

According to BestColleges, 35 states provide free community college starting from 2024. Residents receive tuition coverage through Tennessee Promise and Oregon Promise. There are two types of programs according to Coursera: last-dollar covers remaining tuition after aid while first-dollar covers entire tuition upfront.

Tip: Verify residency and degree status. Explore transfer agreements for four-year schools.

Work Colleges: Learn and Earn

Students at Berea College and Warren Wilson College must complete 6-15 hours of work each week according to standards set by the Work Colleges Consortium. The cost of tuition is eliminated or decreased because educational institutions integrate job opportunities into their programs as reported by U.S. News.

Tip: Ideal for hands-on learners. Confirm work-academic balance.

Employer Tuition Assistance: Work and Study

Google and Chegg provide tuition reimbursement programs that allow employees to receive up to $5,250 tax-free according to IRS. According to the Learn & Work Ecosystem Library 47% of organizations offered tuition assistance in 2020.

Tip: Check tenure requirements. Job hunt with education benefits in mind.

How to Go to Grad School for Free

Teaching Assistantships: Teach and Study

Teaching assistantships provide both tuition coverage and stipends to individuals who teach undergraduate courses according to Cornell Graduate School. Teaching assistants at Duke receive an annual salary of approximately $40,000 according to the Grad School Center. The assigned responsibilities require grading or facilitating discussions for 15-20 hours each week.

Tip: Highlight teaching skills in applications. Verify language requirements, per UConn.

Research Assistantships: Fund Your Research

Research assistantships (RAs) connect students with faculty projects while providing tuition waivers and stipends according to GWU. Doctoral research assistants benefit from complete financial support according to GradSchools.com.

Tip: Develop connections with faculty members working on projects that align with your interests according to ECU.

Fellowships: Prestigious Funding

The NSF Graduate Research Fellowship and Ford Foundation Predoctoral Fellowship provide complete funding for graduate study according to ProFellow. Deadlines are early, per Harvard GSAS.

Tip: Craft strong proposals. Use CARAT for options.

Grants and Scholarships: Targeted Support

The TEACH Grant and fellowships like the Herbert Roback Scholarship at Syracuse University help students lessen education expenses as reported by Sallie Mae. The total amount awarded in grants for 2022/23 reached over $16 billion according to OnlineMastersDegrees.org.

Tip: Research field-specific awards via Fastweb.

Work While Studying: Balance is Key

Graduate students can use part-time jobs such as tutoring positions or employer assistance to cover their educational expenses according to Investopedia. On-campus roles offer flexibility, per Edvisors.

Tip: Prioritize academic performance. Seek flexible hours.

Comparison Table: College vs. Grad School Funding

| Funding Type | College | Grad School |

|---|---|---|

| Scholarships | Merit/need-based, broad options | Field-specific, competitive |

| Grants | Pell, FSEOG, state grants | TEACH, research grants |

| Work Programs | Work-study, work colleges | TAs, RAs, part-time jobs |

| Tuition Waivers | Military, employee dependents | Often tied to assistantships |

| State Programs | Free community college (35 states) | Limited, varies by state |

Success Strategies

- Start Early: Begin the college funding process by submitting FAFSA and scholarship applications as soon as possible according to CollegeVine.

- Apply Broadly: Use Bold.org for quick applications.

- Maintain Grades: You must keep up strong academic performance to stay eligible for fellowships.

- Network: Establish professional relationships with faculty members to secure assistantship opportunities according to GradSchools.com.

- Combine Sources: Secure funding for full tuition by combining multiple financial aid sources according to advice from Coursera.

Real-Life Stories

Personal stories inspire action. John, a non-traditional student, earned a GED, attended free community college via Tennessee Promise, and transferred with scholarships, per Quora. Jane completed her PhD without debt by working as a teaching assistant according to HerCampus. Emily maintained a 10-hour weekly work schedule at Berea College to acquire skills alongside her degree which U.S. News details. These stories, from Goodwin University, show persistence pays off.

Conclusion: Take the First Step

Students can access tuition-free education by utilizing scholarships, grants, assistantships, and various state programs. Graduating without debt becomes achievable when you initiate preparations early and combine multiple funding sources. Start your financial aid search by filling out FAFSA, searching for scholarships at Fastweb, and investigating state initiatives such as Oregon Promise. What’s your next step? Post your plans and questions below to begin your journey right away!